Clio and QuickBooks: Transforming your Client’s Law Firm

Jan 08, 2024In the complex realm of law firms, integrating legal technology and financial systems is far more than a mere convenience; it's an absolute necessity. This fusion of two seemingly distinct worlds can revolutionize operations, bolster accuracy, and ultimately pave the path to a law firm's success. Potential clients frequently find themselves at the crossroads of legal software like Clio and accounting tools like QuickBooks, wondering whether integrating these two powerhouses is worthwhile.

Why should you connect Clio to QuickBooks Online Advanced?

One of the standout advantages of seamlessly integrating Clio with QuickBooks is the effortless transfer of billing information. This integration effectively eliminates the tedious need for manual data re-entry, ensuring precision and reducing the likelihood of errors. Beyond this, the collaboration between these systems delivers improved financial tracking capabilities, facilitates compliance with intricate trust regulations, and empowers law firms with data-driven decision-making prowess. Moreover, it fosters enhanced client communication and satisfaction, enhancing the overall experience for legal professionals and their clients.

What does the setup of Clio to QuickBooks look like?

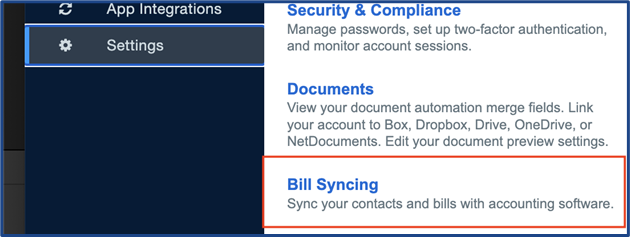

Preparing QuickBooks for integration with Clio software involves several important steps to ensure a seamless connection. Here's a guide to help you prepare QuickBooks for integration with Clio:

- Assess Your Client Needs: Before you begin the integration process, determine your specific requirements. Identify what data you want to sync between QuickBooks and Clio, such as client information, invoices, expenses, and payments.

- Create the Proper Accounts in QuickBooks:

- Set the Closing Date Password: In QuickBooks, you must set a closing date password to protect the data import. Go to the gear>accounts settings>advanced to set this password.

- Map Data Fields: Ensure that data fields in Clio align correctly with the corresponding fields in QuickBooks. This mapping process helps maintain data consistency during synchronization.

- Establish Workflow Procedures: This may be the most important step. Define clear workflow procedures for your team to follow when using the integrated systems. Ensure everyone understands their role in maintaining accurate data and following proper billing and accounting practices.

- Training and Support: Train your client’s staff to use the integrated systems effectively. Address any questions or concerns they may have and offer ongoing support to troubleshoot any issues that may arise.

- Monitor and Maintain: Regularly monitor the integration to ensure that data continues to sync accurately. Address any discrepancies or errors promptly. Stay informed about updates or changes in Clio or QuickBooks that may affect the integration.

What are the downsides of data migration and integration?

However, as with any transformative endeavor, challenges are to be met on the path to integration. These include navigating the learning curve, grappling with potential cost implications, and addressing data security concerns. Establishing a well-structured integration process, providing comprehensive training, and extending unwavering support are paramount to ensure a seamless transition. The efficiency and accuracy that an integrated system brings to the table ultimately outweigh these initial hurdles and are invaluable to the modern management of a law firm.

Set realistic expectations

These above considerations must clearly be explained to your client for a successful data migration. Setting the table properly will ensure a happy client on the other side of the migration. Refrain from telling them that the migration will take a few days to complete when, in essence, the entire process, from start to finish, is approximately 90 days, including two complete billing cycles and staff training.

For bookkeepers in the legal realm, having a sound understanding of these integrated systems is not just beneficial; it's pivotal. Comprehending the significant players' dynamics in the legal and financial software ecosystem is essential. By adhering to best practices and creating a seamlessly integrated workflow, firms can unmistakably recognize the value of their investment in such systems. This knowledge empowers bookkeepers to guide their firms towards informed decisions, optimizing their operational efficiency and financial management.

Integrating legal technology and financial systems is a cornerstone in the modern landscape of law firm management. It's a journey that demands expertise and guidance from professionals who understand the nuances of the legal and financial worlds.

If you have further inquiries regarding data migration or integration software. We encourage you to join our Accountants Law Lab. We delve into the intricate world of legal accounting and technology integration to ensure the success and efficiency of law firms in today's ever-evolving landscape.

Stay connected with news and updates!

Join our mailing list to receive the latest news and updates from our team.

Don't worry, your information will not be shared.

We hate SPAM. We will never sell your information, for any reason.