Master the Art of Law Firm Bookkeeping with Essential Tips for Clio Users

Jul 03, 2023Discover the Best Strategies to Optimize Your Clio Experience

Navigating through different law firm software can be quite challenging, especially when it comes to mastering the intricacies of legal bookkeeping. As a firm that utilizes both LeanLaw and Clio software, I understand the importance of understanding their strengths and weaknesses.

In this post, we'll dive into the world of Clio and explore its unique features and quirks, ensuring seamless integration into your bookkeeping processes.

Streamline Your Sync with Clio and QuickBooks

The one-way sync can be a bit perplexing, but fear not, Clio syncs effortlessly with QuickBooks. When a client inputs an invoice, it automatically synchronizes and pushes it into QuickBooks. However, there are cases where our clients make errors and adjust their entries, resulting in duplicate transactions. By staying on top of this, you can address any discrepancies and ensure accurate financial records.

Connect Clio and QuickBooks for Compliance Purposes

Connecting Clio to QuickBooks is crucial for compliance reasons. By validating the two platforms together, you can ensure accurate three-way reconciliations. So don't believe the misconception that Clio shouldn't be connected to QuickBooks. Embrace this integration for better financial management.

Organize Your Finances with Ease

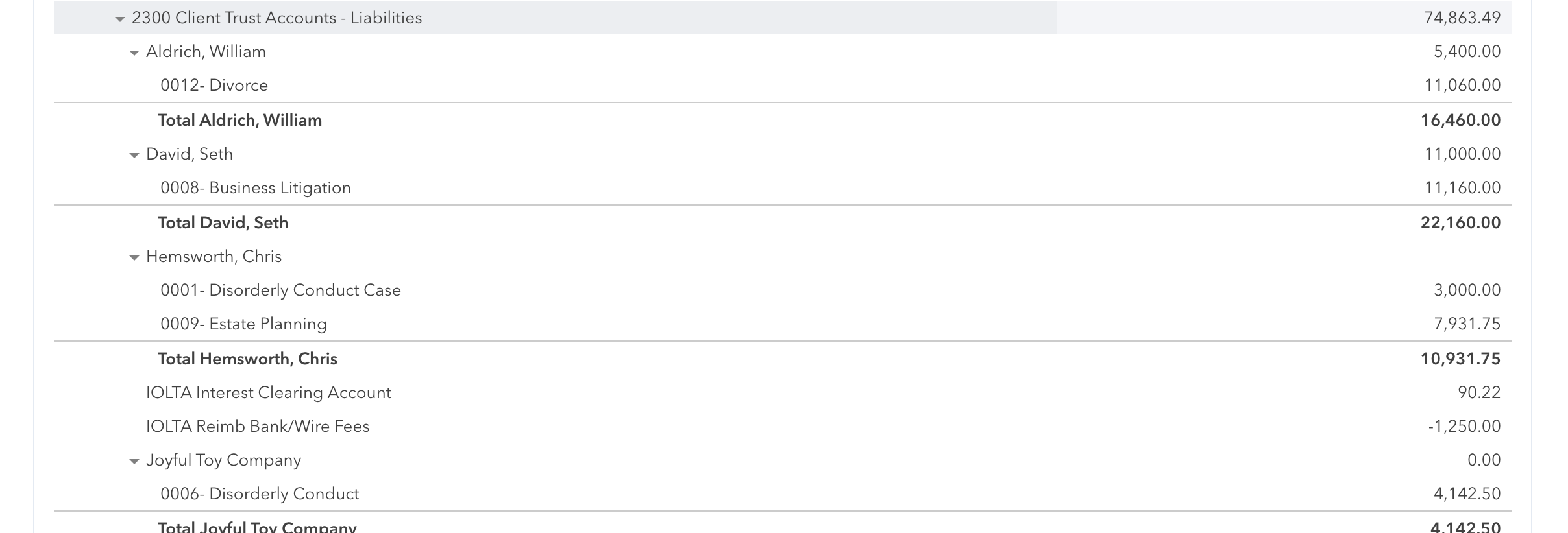

Proper organization is key to effective legal bookkeeping. Utilize the reclass tool in Clio to push transactions from the trust header liability account into sub-ledger accounts for each client. This gives a comprehensive overview of client balances, providing better financial insight.

Properly Manage Your Operating Bank Account

While syncing in Clio is convenient, it's important to note that the operating bank account in Clio may not match QuickBooks unless you manually input every transaction. Save yourself the duplicate work and unnecessary hassle by only entering transactions that occur in your bank feed directly into QuickBooks.

Optimize Your Reporting with Clio

Clio's reporting capabilities are minimal, but fear not! Leverage the Clio trust ledger report to validate your trust balances. Be cautious of the trust listing report, as it may not provide the correct balances needed for accurate reconciliation. Customize your settings for the trust ledger report to ensure accurate reporting and balance validation.

Addressing Imbalances

In case your financial statements don't balance, here are a few areas to check:

- Clio Payments: Utilize the Clio payments report to track deposited payments. Be wary of merchant fees, as they can cause discrepancies. Adjustments may be needed to align the numbers correctly.

- Consider Batch Merchant Fee Deductions: If feasible, ask clients to request that merchant fees be deducted monthly instead of with each transaction. This simplifies the process and ensures your payments match the bank feed seamlessly.

Master Legal Bookkeeping with Confidence

By following these tips and strategies, you can conquer the world of legal bookkeeping with Clio. Stay organized, validate your balances, and optimize your financial reporting. With Clio and QuickBooks integration, you'll become a master at managing your law firm's finances.

If you want to learn more about topics like this, join us in our Facebook group, The Accountants Law Lab.

Stay connected with news and updates!

Join our mailing list to receive the latest news and updates from our team.

Don't worry, your information will not be shared.

We hate SPAM. We will never sell your information, for any reason.