Seven Essential Steps for Bookkeepers to Clean Up a Law Firm's QuickBooks File

May 29, 2023Like any other business, law firms require accurate financial records to ensure their operations run smoothly. However, keeping track of finances can be tedious, especially if the financial records are disorganized or contain errors. A bookkeeper can help clean up a law firm's QuickBooks file to ensure an accurate financial record. Here are the 7 essential steps bookkeepers can take to accomplish this task:

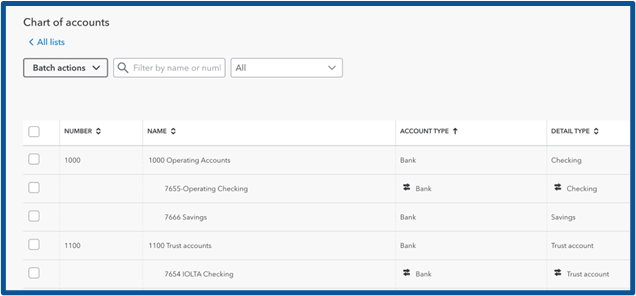

- Verify the Chart of Accounts

The first step in cleaning up a law firm's QuickBooks file is to verify that all bank accounts are set up correctly and match the chart of accounts. I have seen bank accounts with the most unique names throughout my work with attorneys and law firms. Put the 4 digits of the account number first, as the screen is truncated on the banking window of QuickBooks. The bank accounts should also be separated by type, with a parent of Operating and Trust Bank accounts. This step is crucial in ensuring each account is classified as an asset, liability, equity, revenue, or expense. By reviewing the chart of accounts, the bookkeeper can ensure that all the accounts are relevant and appropriately named.

- Error Correction

The next step is to check for and fix any errors in the file. This could include correcting data entry mistakes, fixing discrepancies between the bank statement and the QuickBooks file, and ensuring that all transactions are correctly classified. For example, the bookkeeper must identify and correct these errors if a payment is recorded in the wrong account, or a transaction is duplicated.

- Transaction Recording

After correcting errors, the bookkeeper must ensure that all transactions are correctly recorded and categorized. This includes assigning each transaction to the correct account and ensuring all expenses match the corresponding income. For example, if the law firm receives a payment for a legal service, the bookkeeper needs to record the transaction in the correct income account.

- Bank Reconciliation

The bookkeeper must reconcile all bank accounts to ensure the QuickBooks file matches the bank statement. Reconciliation involves comparing the bank statement to the QuickBooks file and identifying discrepancies. For example, if a transaction is recorded in the QuickBooks file but not on the bank statement, the bookkeeper needs to investigate and correct the error.

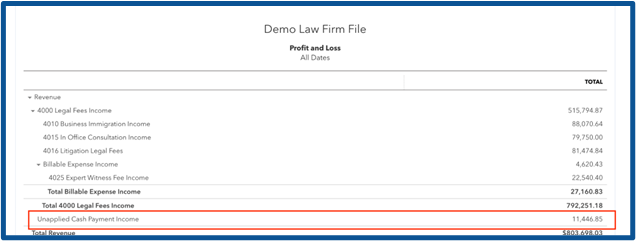

- Unapplied Payments and Credits

The bookkeeper needs to check for and correct any unapplied payments or credits. Unapplied payments or credits occur when a payment or credit is not applied to an invoice or bill. This can result in inaccurate financial records and lead to confusion. For example, if a payment is received for an invoice but not applied to that invoice, the bookkeeper needs to apply the payment to the correct invoice.

- Financial Reports

The bookkeeper needs to run and review financial reports to ensure the information in the QuickBooks file is accurate and complete. Financial reports provide an overview of the law firm's financial health and are essential for making informed business decisions. For example, the bookkeeper may run a profit and loss report to analyze the law firm's revenue and expenses.

- Documentation

Lastly, the bookkeeper must ensure that all transactions are adequately supported by documentation, such as invoices or receipts. Documentation is critical in the case of an audit or when analyzing financial reports. Ensuring all transactions are appropriately documented, the bookkeeper can create a comprehensive financial record for the law firm.

Following these 7 essential steps, bookkeepers can help ensure that a law firm's QuickBooks file is accurate, organized, and current. A well-maintained QuickBooks file provides the law firm with valuable information for making informed business decisions. Want to learn more about legal bookkeeping? Take our course, Fast Track Legal Accounting.

Stay connected with news and updates!

Join our mailing list to receive the latest news and updates from our team.

Don't worry, your information will not be shared.

We hate SPAM. We will never sell your information, for any reason.