Trust Accounting is Easy!

Jun 30, 2025

Catchy title, right? Isn’t trust accounting supposed to be complex? Isn’t that the one process that trips up attorneys and bookkeepers new to legal accounting? The answers to the above are yes, yes, and yes!

Broken down to its most basic form, it can be easy if maintained. You MUST know the rules to the jurisdiction where your client practices law.

Fortunately, the folks at MyCase provided us with a fantastic link to all the different state and bar rules. That’s always your first stop, especially if you are a cloud-based accountant or bookkeeper. Every state has different rules, and some states even have rules that vary by county. See, you need to dig deep to understand exactly what is expected of the attorney and the law firm.

What You Need to Know

Trust accounting, at its most basic level, is the initial funds received by the law firm, which are pre-payments. These pre-payments are called retainers. It’s just as important to understand the language that the law firm or the attorneys use when working with legal clients.

Because these pre-payments are not the law firm's money until earned, these are the instances where those bar rules apply. Mismanagement of trust account funds can result in fines or in the most severe case, can result in an attorney losing their license to practice law. That’s why managing funds is so critical.

The best way to monitor trust accounts is to have complete visibility of the records. Since the trust receipt of funds or a retainer is a liability, it can be broken down to this simplest entry:

- Debit the trust bank account.

- Credit the trust liability account.

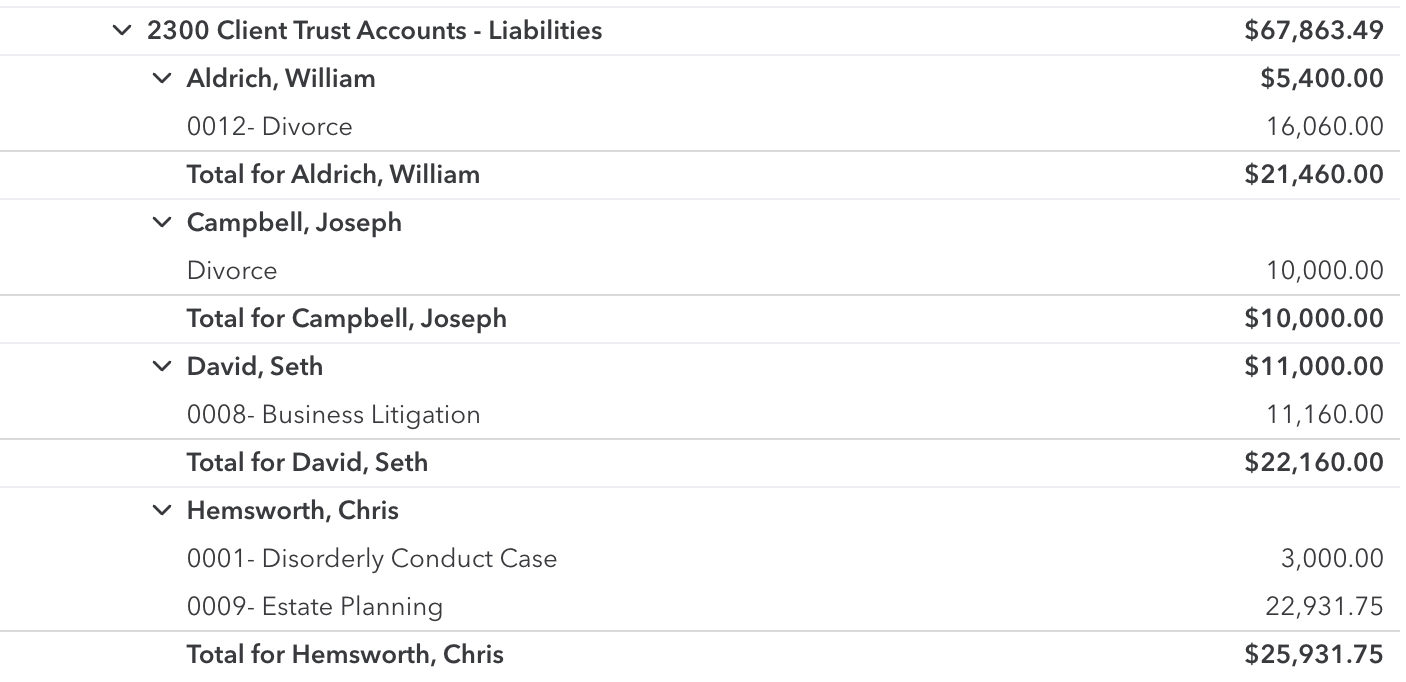

Depending on the software used, it can be placed into one trust account and tracked by the customer name or our preferred method is to create subledger accounts and track the individual client registers in these subledger accounts. In QuickBooks, the register would look like this:

That’s for the money in. Now, depending on the firm and the rules, attorneys sometimes use the funds directly from the trust/IOLTA bank account to pay for client expenses. Sometimes they use their operating funds and bill that back at the time of invoicing when the revenue is earned.

If client fees are paid out of the trust bank account, The Transaction would look like this:

Debit: client trust liability account (matter level)

Credit: trust bank account

If the expense for the client is paid from the operating account, that’s a different story. Then the funds would be booked into the advanced client cost account for the debit, and the credit would be the operating bank account.

Pro Tip: I don’t want to trip you up with debits and credits, but in QuickBooks, you can click the More button at the bottom of any transaction to view the transaction journal. That will provide you with the debits and credits to validate that you are booking these transactions correctly.

If client expenses were paid out of the operating bank Account, they are billed back to the client at the time of invoicing. Those expenses are added to any time that the attorney has tracked, and this is typically done either monthly or twice a month. This depends on the firm and the practice area.

The 3-way bank reconciliation

Another crucial step, which is part of compliance when working with attorneys, is the three-way bank reconciliation. The three ways are:

- The bank statement ending balance, plus or minus any in-transit transactions

- The balance in the trust bank account, which is reconciled to the bank statement

- The balance of all of the individual trust ledgers from the client’s billing software (Clio or LeanLaw)

I would be remiss in writing an article on trust accounting without mentioning legal software. Software like Clio or LeanLaw helps attorneys and you track these trust matters and clients.

Additionally, the software helps ensure that you don’t overstate or send back more money than the client initially provided. We never want to see negative trust liabilities. Legal tech software makes it easy and quick to track trust matters.

If you use QuickBooks as a stand-alone, it can be done, but there are numerous workarounds for manual processes that make this an inefficient choice when working with attorneys. The small investment in the software will pay itself back in dividends with time savings and accuracy.

I hope you enjoyed this article on the basics of Trust accounting. It’s a topic we are passionate about at our firm and with our group, The Accountants Law Lab. We hope you join us to learn this topic in more detail.

Stay connected with news and updates!

Join our mailing list to receive the latest news and updates from our team.

Don't worry, your information will not be shared.

We hate SPAM. We will never sell your information, for any reason.